Key economic indicators continue to improve, with several leading economies beginning to report modest increases in inflation. High-frequency indicators, such as business surveys, are off their peak readings but remain elevated in a historical context.

Meanwhile, global equities have rallied for the fifth consecutive quarter, buoyed by vaccine rollouts supporting strong corporate earnings results.

183 million cases of COVID-19 have now been recorded, with an increase of 13 million in June. At their June meeting, the G7 agreed to distribute 870m surplus vaccines; however, the IMF has urged the G20 to do more to end the growing divergence of vaccine distribution.

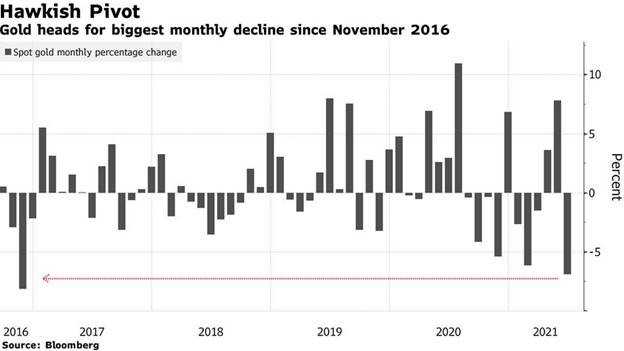

At its June meeting, the U.S. Federal Reserve triggered a shift in market sentiment with a somewhat hawkish tone. The rotation from growth to value reversed partially as long-term interest rates declined along with inflation expectations.

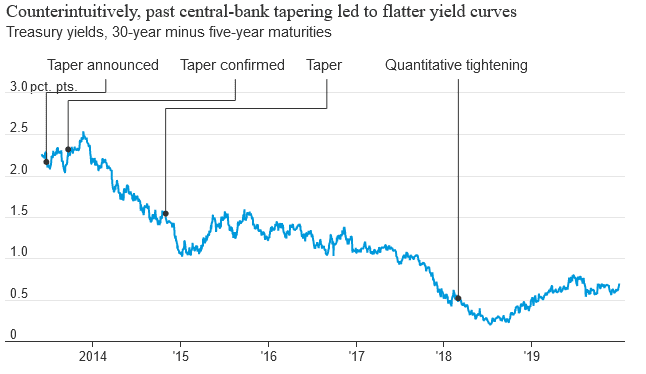

Expectations of bond tapering and hikes in short-term interest rates increased as the market interpreted policy tightening with slowing economic activity while also pricing in cash rate hikes, leading to a rise in shorter-dated bond yields and a rising US Dollar.

Equities

Developed market equities rose by 2.4% in June as the value rotation stalled and investors moved back into growth stocks.

The S&P/ASX 200 Value Index returning 1.6% for the month, versus a return of 3% for the S&P/ASX 200 Growth Index. Overall, the ASX 200 rose 2.3% in June and 27.8% for the fiscal year, the strongest financial year return since 2006/07.

Emerging market equities gained 0.9% in June, given the relatively low vaccination rates and the rise in new cases in some economies.

Upward revisions in earnings continue, with US and European earnings expected to grow 37% and 44% respectively this year. Australia is expected to lag with earnings growth of just 29% in this calendar year.

Property

Australian listed property achieved strong results in June, posting a 5.6% gain and finishing the month with 33.9% YTD.

Residential property markets also advanced further in June, with CoreLogic's Daily Home Value Index reporting the five-city aggregate increasing by 1.9%. Sydney led the charge, achieving 2.6%, and Melbourne lagged the aggregate with 1.5%.

CoreLogic's data also indicates that the rise in residential property prices has outstripped rents in all cities but Perth and Darwin, despite national rents rising 5.6% in the year to May, the fastest annual increase since February 2009.

Rates and Credit

In June, yields at the long end of the Australian Sovereign curve fell, with the 10-year yield falling by 17 basis points to 1.53%.

This movement drove solid returns for the Bloomberg AusBond Composite 0+ Yr Index, which increased by 0.70 over the month; however, the Australian yield curve flattened as 3-year yields rose c.35 basis points.

The U.S. yield curve also flattened following hawkish signals from the Fed, with the U.S. 10-year government bond yield falling 13bps to 1.45% by the end of June.

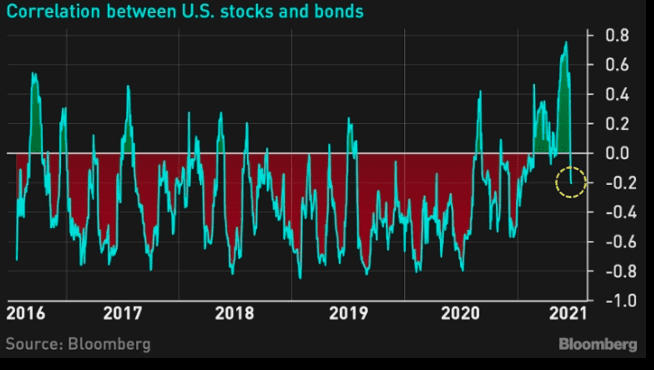

Importantly for diversified portfolios, the rally in treasuries has helped bring one month correlation between the Bloomberg Barclays and the S&P 500 index back below zero, where they have spent much of the past five years, after turning positive for a large part of 2021.

Credit spreads narrowed during June, with investment grade and high yield spreads at or near their tightest levels ever. Supporting tighter spreads, the default rate on U.S. high yield bonds fell to 1.6% in June after peaking at over 6% as recently as February of this year.

Commodities

A steady rise in demand and a steady decline in inventories has supported the oil price, with the price of a barrel of Brent oil rising to USD 74.76 from USD70 per barrel at the start of June.

A rising dollar and fading inflation risk and expectations lead to a fall in the price of Gold over June, while iron ore prices surged to USD212/Mt amidst solid demand and supply constraints.

A combination of green energy, inflation expectations, infrastructure spending and easy money have helped copper prices nearly double since late 2019. June saw some price weakness with China releasing part of its state copper reserves into the market, and hawkish signals from the Fed.

FX

Shifts in Fed speak created a 2.9% surge in the U.S. dollar index in June as it appreciated against most currencies in the index.

The Australian dollar dropped 3.1% against the US Dollar, spending much of June around the USD 0.75 level. Dollar strength may persist in the near term as the Fed looks to be leading the charge on policy normalisation.

Australian Economy

Maintaining its focus on the real economy, the Reserve Bank of Australia (RBA) remains committed to seeing realised inflation within its target range of 2-3% before raising the Cash Rate from its current record low level of 0.1%. They do not expect inflation to be within their target range until 2024.

However, a recent announcement where the central bank declined to switch its target bond for yield curve control from April 2024 to the November 2024 issue has been widely interpreted as a prelude to gradually removing stimulus. In this respect, the RBA is moving in tandem with other central banks beginning similar discussions as the global economy surpasses projections in its recovery from COVID.

The labour market has continued to recover faster than expected. More Australians are in some form of employment than before the pandemic, and the unemployment rate in May was 5.1 per cent, a 17 month low. Despite this strong recovery in jobs and reports of labour shortages, inflation and wage outcomes remain subdued. Wages grew by 1.4% in the first quarter of the year.

The Westpac-Melbourne Index of Consumer Sentiment fell 5.2% in June, mainly due to concerns about Melbourne's two-week lockdown.

The Markit manufacturing PMI index fell 1.8pts to 58.6 in June, slightly higher than the estimate of 58.4 as factory orders and output slowed.

U.S. Economy

The United States continued to re-open, with 64.5% of the adult population fully vaccinated by the July 4th holiday, just shy of the 70% target President Biden set for the vaccination' month of action'.

U.S. economic data and business surveys remain strong, however the labour market has sent mixed signals of rising employment and a higher unemployment rate. US Non-farm payrolls surprised in June, adding 850,000 jobs, well ahead of the 700,000 jobs expected.

The unemployment rate increased from 5.8% to 5.9%, with the participation rate essentially unchanged at 61.6%.

As expected, the PMI Composite Index fell 5 points 63.7 in June, reversing the gains made in May, with the services PMI down from 70.4 to 64.6.

Personal incomes fell 2.0% in May (-2.5% expected), as government social benefits rolled off further (statisticians record the withdrawal of stimulus as a drop in personal income), while personal spending rose at 0.1%, below the expectation of 0.4%.

The international goods trade deficit widened to $88.1 billion in May, above expectations of $ 84.0 billion.

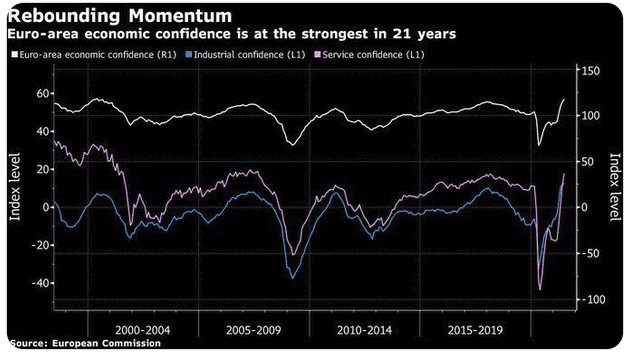

European Economy

After starting the year in recession, the eurozone economy is on track to record strong economic growth when second-quarter figures are released. Exports, industrial production, retail sales and consumer confidence have all surged in the last month.

Eurozone economic sentiment increased 3.4pts to 117.9 in June, beating expectations of 116.5 and reaching a level just below the 21 year high of 118.20 in May 2000.

Sentiment was supported by hopes of a robust economic recovery, particularly among service providers, with the highest sentiment since August 2007.

The ECB also revised its GDP projections for 2021 and 2022 upwards to 4.6% and 4.7%, respectively.

The June Markit manufacturing PMI achieved a record high of 63.4, from an expected 63.1, marking the twelfth successive month of expansion in the sector. The Markit Composite PMI increased to 59.5 in June, broadly in line with expectations.

Retail sales surged 4.6% in May while CPI eased to 1.9% in June from a two year high of 2% in May. PPI grew 1.3% in May, slightly higher than the expected 1.2% and taking the year on year increase to 9.6%. The unemployment rate fell to 7.9%, slightly below expectations of 8.0%.

The United Kingdom's Covid-19 vaccine program accelerated in June, with 62.4% of adults fully vaccinated and 84.9% having received at least one dose by the end of the month.

In the U.K., the Markit/CIPS Composite PMI fell to 62.2, slightly ahead of expectations of 61.7.

Retail sales volumes declined by 1.4% in May, following a sharp increase in April when the government eased retail restrictions. Despite the monthly decline, total retail sales were up 9.1% compared with their pre-pandemic February 2020 levels.

The PMI Composite Index came in at 62.2, ahead of expectations of 61.7.

Asian Economy

China's inflation data disappointed in May, with month-on-month inflation contracting 0.2% (-0.1% expected), with the yearly inflation rate coming in at 1.3%.

The unemployment rate fell in May to 5.0%, the lowest rate in two years. Retail sales slowed to 12.4% year-on-year in May 2021, missing the expectations of 13.6% and pulling back from the 17.7% increase in April.

The Caixin Composite PMI fell 3.2pts to 50.6 in May, the lowest reading since April 2020, due to concerns over the epidemic situation in the export hub of Guangdong that led to a reintroduction of travel restrictions.

The Chinese government announced that they were moving away from the reliance on Australian iron ore, but this had little effect on iron ore prices as they peaked at US$229.50.

Late in June, Japan again extended its state of emergency ahead of the Olympic Games.

The Japan consumer confidence index increased by 3.3 points to 37.4 in June (33.0 expected), marking the strongest reading since February 2020, as all main sub-indices improved.

Retail sales fell 0.4% in May, well below expectations of 1.9% growth, as the yearly rate rose 8.20% (7.9% expected), marking the third straight month of increases, as consumption recovered further from the COVID-19 disruption.

The central bank also extended the September deadline for its pandemic-relief programme by six months. CPI expanded 0.3% in May, ahead of expectations of 0.1%, as the yearly rate improved to -0.1%.

Sources

This article contains information first published by Lonsec. Voted Australia’s #1 Research House for 2019.

General Advice Warning

The information on this website contains general information and does not take into account your personal objectives, financial situation or needs. You should consider whether the information and any general advice provided is appropriate for your personal circumstances and where uncertain, seek further professional advice before taking any action.

Important Information

Walbrook Wealth Management is a trading name of Barbacane Advisors Pty Ltd (ABN 32 626 694 139; AFSL No. 512465). Barbacane Advisors Pty Ltd is authorised to provide financial services and advice. We have based this communication on information from sources believed to be reliable at the time of its preparation. Despite our best efforts, no guarantee can be given that all information is accurate, reliable and complete. Any opinions expressed in this email are subject to change without notice, and we are not under any obligation to notify you with changes or updates to these opinions. To the extent permitted by law, we accept no liability for any loss or damage as a result of any reliance on this information.