This fact sheet provides additional information to help with understanding the investment, tax and other financial planning concepts that we have discussed with you or included in your Statement of Advice.

Please contact your adviser if there is any aspect on which you need further information or clarification.

What are Futures?

A future is a contractual obligation of the buyer or seller to purchase or sell an asset (underlying) at a predetermined price in the future. Futures contracts are highly-standardised, with large amounts of buyers and sellers creating deep, liquid markets.

Key Features

Futures are available on many underlying assets and asset classes, with the most common being:

- Index futures

- Interest rates

- Commodities (e.g. wheat, crude oil) / precious metals

- Foreign exchange rates (forwards)

- Equities

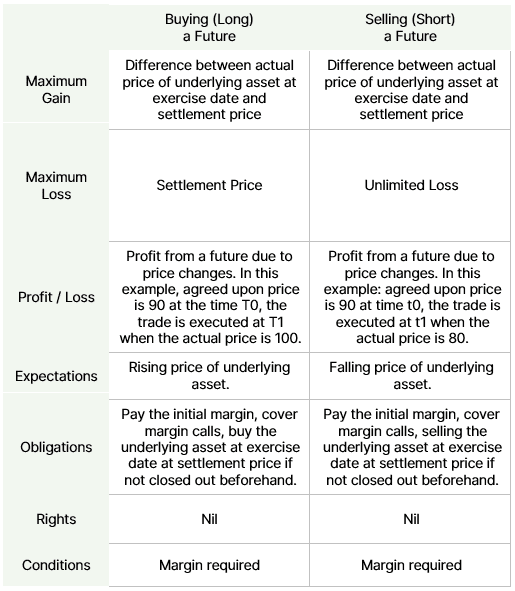

Market participants use futures for hedging or speculation, and two positions exist:

- long positions involve buying a future, profiting when the price of the underlying moves higher

- short positions involve selling a future, profiting when the price of the underlying moves lower

Similar contracts traded over the counter (OTC) with the potential of customisation are referred to as forwards.

Opening a position

When opening a position in a futures contract, the investor is required to post an initial margin with the clearinghouse.

The initial margin required depends on the volatility of the underlying. However, it will be substantially less than the gross exposure to movements in the underlying asset price.

This minimum deposit is necessary to collateralise the contract and serves to protect the counterparty.

Maintaining a position

Daily, gains (losses) are credited (debited) against the margin account. This daily 'mark to market' ensures that the position continues to be adequately collateralised.

If the balance of the margin account falls below the required level (maintenance margin), the investor will be margin called and required to make an additional deposit up to the initial margin or close out some of the position.

The price of a futures contract primarily depends on the cost of carry, which reflects interest rates, storage costs and other holding costs for the seller remaining in possession of the underlying asset over the period to expiry.

On a financial asset, the costs reflect the interest earned in a risk-free alternative investment while the profit is any dividend received.

For physical assets, the futures price can also be affected by seasonal effects, climate, geopolitical events or storage limitations, as occurred in the oil market in April 2020.

When comparing the price of a futures contract to the current (spot) price, two market conditions exist:

- Contango - the spot price is lower than the value of the next futures contract to expire.

- Backwardation - the spot price is higher than the cost of the next futures contract to expire.

Understanding whether the market is in contango or backwardation is particularly important where the underlying is a physical commodity. Due to natural disasters, storage limitations or other factors affecting supply, the price of futures contracts may change suddenly even if the spot price does not.

Settlement of a position

A position can be closed in two ways:

- The investor 'closes out' the contract before expiry by entering a closing transaction that mirrors the opening trade, e.g. if you sold 1,000 to open, you would buy 1,000 to close.

-

If a future is not closed out before maturity, it can be settled by either:

- Cash Settlement – the counterparties exchange the difference between the strike and the actual value of the underlying, in cash.

- Physical Delivery – The counterparties exchange the actual underlying, e.g. a tonne of wheat, against cash.

Contracts that have a physical asset as an underlying, e.g. commodities such as crude oil, wheat, iron ore) are usual settled by physical delivery. Contracts based on financial indices or other reference rates settle in cash.

Because futures are obligations, if a position in a physically settled futures contract is only speculative, to avoid forced delivery of the underlying asset the contract must be closed out before expiry.

Once the futures contract is closed, the clearinghouse returns the initial margin along with any maintenance margin.

Forwards

Forwards are similar to futures with regards their purpose: they allow one to buy/sell an asset at a specific time at a particular price.

The significant difference is that futures are standardised exchange-traded contracts, while forwards are private agreements between two parties that are less rigid in terms and conditions.

As a result, forward contracts are often used by companies for hedging purposes and tend to be settled by cash or delivery of the underlying. Futures contracts are frequently closed out before maturity without actual delivery taking place at all.

Investment Horizon

Short Term

Income Expectation

Capital Gain

Market Expectation

Increasing / Decreasing

Advantages and Disadvantages

Advantages

- Capital-efficient way to gain access to desired gross exposure

- Cost-effective and fast way to hedging existing positions

- Wide range of underlying assets

- Liquidity

Disadvantages

- Complexity

- Minimum contract sizes

- When speculating, strategies such as leverage and short selling bear the risk of over proportional or even unlimited losses

- Leverage combined with the volatility of the underlying can amplify losses and trading errors

Risks of Futures

Price Risk

When short selling (i.e. selling the future without owning the corresponding underlying asset) the seller is obligated to buy and deliver the underlying asset at the exercise date. For example, the seller is forced to buy the underlying asset at market conditions that may be unfavourable.

Market Risks

The market risk of the underlying asset is directly reflected in the price and payoff of the future.

Leverage

The initial margin required depends on the volatility of the underlying. However, it will be substantially less than the actual contract volume. Therefore, a small investment amount moves a far larger value in terms of the underlying. This leverage amplifies potential losses and contributes significantly to the risks of this instrument.

Counterparty Risks

Over the counter instruments such as forwards constitute a direct contract between the buyer and the counterparty, thus they have increased counterparty risk and potentially increased liquidity risk (depending on the level of standardisation).

Margin Call Risk

Adverse market movements may require the investor to post additional cash or securities, or close some or all of their position at a loss.

Important Information

Walbrook Wealth Management is a trading name of Barbacane Advisors Pty Ltd (ABN 32 626 694 139; AFSL No. 512465). Barbacane Advisors Pty Ltd is authorised to provide financial services and advice. This post is general information only and is not intended to provide you with financial advice as it does not consider your investment objectives, financial situation or needs, unless expressly indicated otherwise. You should consider whether the information is suitable for your circumstances and where uncertain, seek further professional advice. The author has based this communication on information from sources believed to be reliable at the time of its preparation. Despite our best efforts, no guarantee can be given that all information is accurate, reliable and complete. Any opinions expressed in this email are subject to change without notice, and we are not under any obligation to notify you with changes or updates to these opinions. To the extent permitted by law, we accept no liability for any loss or damage as a result of any reliance on this information.